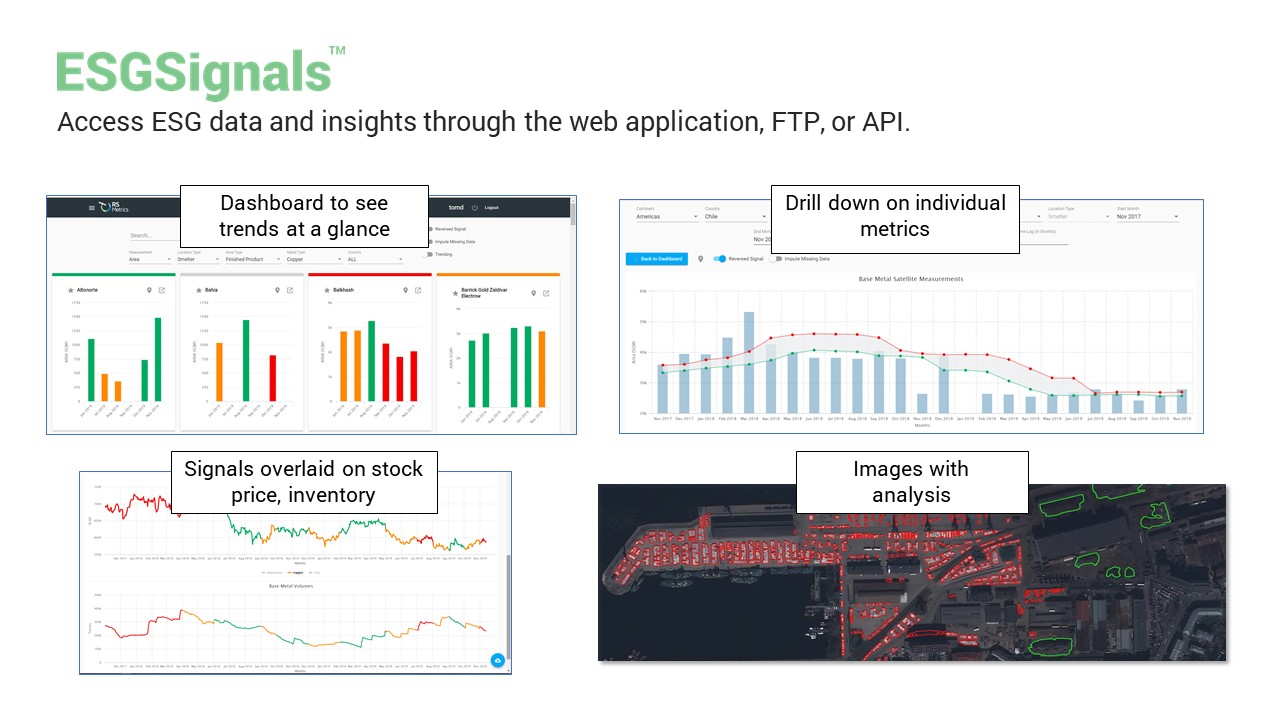

ESGSignals®

What is ESG?

We will walk you through the universe of Environmental, Social and Governance Investing.

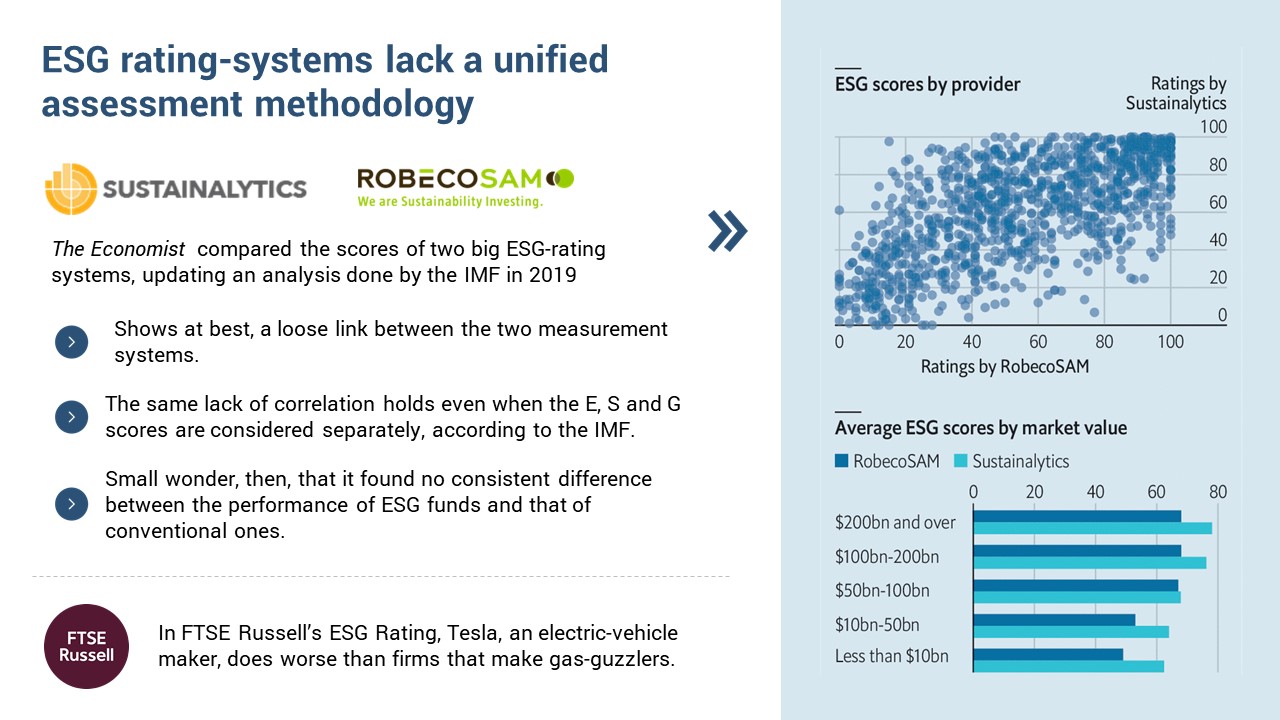

Do you know why current ESG ratings are NOT working?

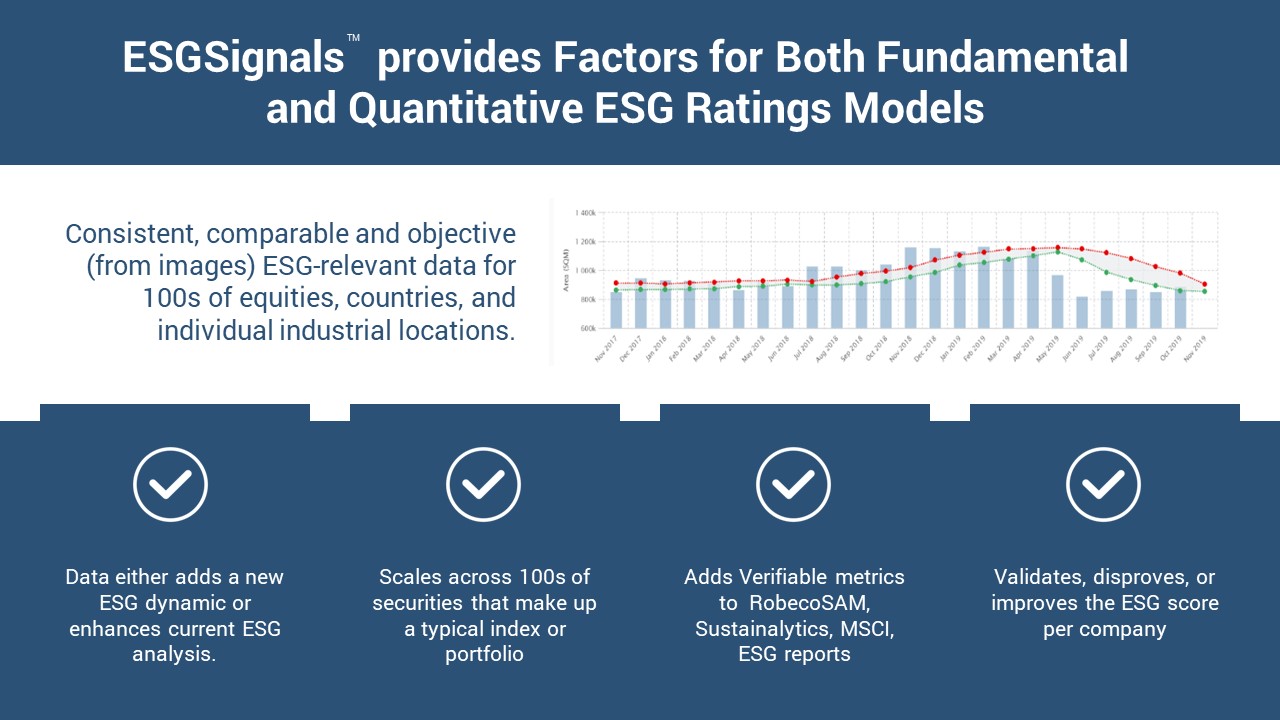

- Unlike credit ratings provided by S&P, Moody’s etc. ESG scores are poorly correlated with each other with ESG-rating firms not being able to agree about which companies are good or bad

- The scoring systems sometimes measure the wrong things and rely on patchy, out-of-date figures. ESG Ratings are issued on a pass/fail basis which provide no real insights on ESG issues.

- Firms who are better able to afford disclosure tend to get better ESG scores. However, even when figures are disclosed, they may be too out-dated to be useful.

- At present only half the 1,700-odd companies in the MSCI world index reveal their carbon emissions. And those who do not, are penalized for non-disclosure - with strange results.

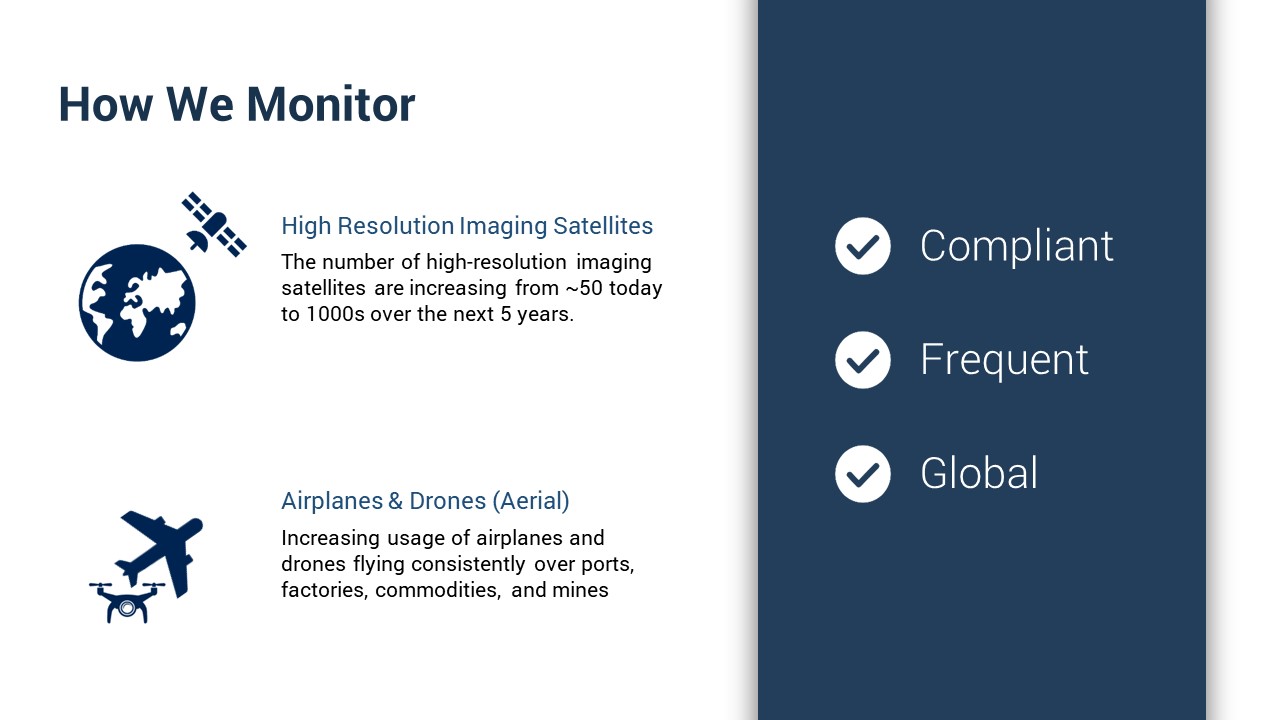

Investors and asset owners are demanding an objective source on ESG Ratings that is:

- Up-to-date

- Independent

- Proactive

- Verified

Investors are holding companies responsible for their long-term impact on the environment and community while expecting to make better long-term returns from their investments

ESGSignals® Produces

Weekly measurements for each location:

- Land usage (perimeter of property, construction)

- Environmental impact (air quality, pollutants, emissions)

- Employment (employee cars)

- Clean energy (Renewable energy project progress)

- Production and raw materials usage (semi-trailer trucks, rail cars, stockpiles, products)

ESGSignals® Value Propositions

| Asset Managers | Asset Owners |

|

|

|

Quant Managers (Ratings, Models, Metric Providers) |

Fixed Income Investors |

|

|

|

Issuers |

|

|

|

Other RS Metrics Products:

For in-depth Discussions Contact:

Kirti Khanduja

+1 (917) 477 7004